Retirement Income Planning

Find The Right Retirement Income Strategy For You

Retirement can be very confusing.

With all the different strategies, solutions and products available to retirees and near-retirees today, it can become extremely difficult to try to determine which is the right strategy for you. Not to mention, the constant junk mail, the television commercials, the newspaper & magazine articles, the unlimited spam emails and the constant ‘free gourmet dinner’ invitations. Needless to say, it can become overwhelming very quickly.

At Income For Life, we do our best to simplify this process for you by offering ‘common sense’ ideas and strategies that are built to make sure that you STAY retired. In retirement, it is very clear that retiring is easy, but staying retired is difficult. We will make sure that you have a retirement plan that is built to guarantee that when you retire, you stay retired.

For example, here is what we mean by a ‘common sense’ retirement:

- When you retire, what are you no longer receiving every two weeks? That’s right: your employer paycheck.

- You have a nest egg set aside for retirement purposes, right? Yes. This could be an employer plan, a brokerage account, a bank account or a combination of all three.

- Wouldn’t it make ‘common sense’ to use a portion that retirement nest egg to replace the paycheck that you are no longer receiving and have it last the rest of your life? Of course it does – that is why most saved up their nest egg in the first place.

In retirement, the goal should be GUARANTEED INCOME. You must have a guaranteed income stream that will last you for the rest of your life. Without it, you could be forced back into the workforce later in life, which no one wants to be forced to do – but we see it happen to many retirees across the nation.

To help simplify your retirement process, we assist our clients with a clear understanding of the three retirement income choices from which to choose from. These choices are:

- The Bank Way

- The Wall Street Way

- The Insurance Way

How are You Going to Pay for Retirement?

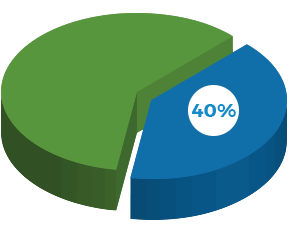

The Average Amount of Thought Given to Retirement Planning Prior to Retirement

(Source: http://fundreference.com/articles/2015/1001362/retirement-savings-stats/)

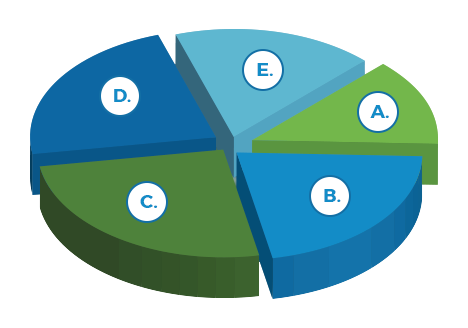

According to the United States Census Bureau, an expected 20.7% of the American population will be over the age of 65 by 2050. This is up from 12.4% of the population in 2000. Do you know how you’re going to guarantee a consistent income when you reach retirement age?

- A. 13% of Non-Retired Adults Give Retirement a Lot of Thought

- B. 21% of Non-Retired Adults Give Retirement a Fair Amount of Thought

- C. 25% of Non-Retired Adults Give Retirement Some Thought

- D. 22% of Non-Retired Adults Give Retirement a Little Thought

- E. 17% of Non-Retired Adults Give Retirement No Thought

Current Retirement Trends

The Average Amount of Thought Given to Retirement Planning Prior to Retirement

(Source: http://money.usnews.com/money/blogs/planning-to-retire/articles/2016-02-12/5-baby-boomer-retirement-trends)

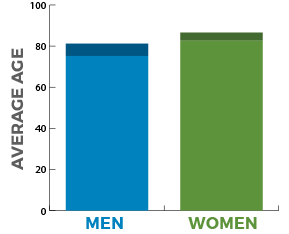

Living Longer

Fact: Both men and women are living longer. Men are expected to live an average of six years longer and women an average of four years. Result: The money that individuals are saving for retirement may not sustain them for their lifetime. More money is needed in order to make it through the additional retirement years.

Changes in Retirement Planning

Fact: Pension plans cover only 11% of individuals that were born in 1980 or later. Additionally, over 40% of individuals expect to make it through retirement on their 401(k) alone.

Result: There are fewer options to accrue money for retirement than there were 50 years ago. Going forward, individuals need to be more aware of the expenses and retirement financial needs.

Working Longer

Fact: In just a decade, the number of men who work longer and postpone retirement grew by 11% and the number of women doing the same increased by 12% Result: Working longer allows individuals in good health to put more money into a 401(k), savings, and other investments. This also allows individuals to reduce the amount of time they need their retirement money to last.