Social Security Planning

The biggest story in Social Security today concerns the large number of baby boomers set to retire over the next 20 years and the relatively smaller younger generations feeding Social Security payroll taxes into the system. On average, today’s seniors are living longer than any previous generation. While that’s good news, it also presents several new challenges. A longer life increases the likelihood that you’ll have increased medical and long-term care expenses throughout much of your retirement. This is particularly true if you’ve been active all of your life – as many of today’s baby boomers have been.

Furthermore, the value of your nest egg could be more significantly impacted by increases in the cost of living over a longer term. Quite simply, you could outlive your savings. When you consider all of these factors, it is important to make informed decisions about when to begin receiving Social Security benefits within the context of your overall retirement income strategy.

Other sources of retirement income, such as pension plans, 401(k) plans, IRAs, annuities, tax-exempt and taxable securities should be carefully evaluated in light of various factors. For example, generating a reliable fixed income versus variable, at-risk income. You may want to consider speaking with a financial advisor or insurance agent to help develop a retirement income strategy before you apply for Social Security benefits.

There are strategies you can employ to help reduce the risks of outliving your money. These strategies may be directly related to when you start taking Social Security benefits and how you should consider positioning assets for a surviving spouse.

Contact us today to set up your free Social Security Review to determine the best strategy available to you.

“The Treasury and the IRS are announcing steps that will ease regulatory barriers in the market for annuities and other forms of lifetime income.”

Source: Alan Krueger, Council of Economic Advisors, WhiteHouse.gov. Feb 2012.)

Social Security Planning Explained

- 66% Retired Workers

- 15% Disabled Workers

- 10% Survivors of Deceased Workers

- 8% Dependents of Retired or Disabled Workers

Common Misconceptions About Social Security and Retirement

Myth: Social Security retirement benefits and payouts will stay the same or decline after age 66.

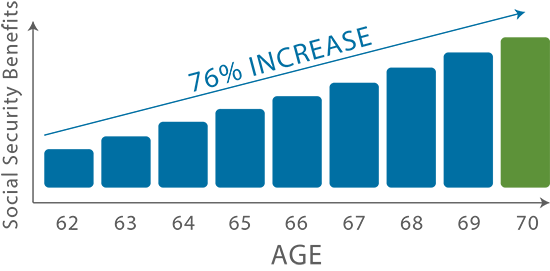

Fact: 42% of the population believes that your benefits will decline as you age. This is simply not true. Overtime, your benefits can increase as you age and other factors come into play.

Myth: Age 65 is the earliest age in which you can qualify for and claim Social Security retirement benefits.

Fact: Actually, the earliest age any individual can apply for Social Security retirement benefits is 62 and at 70 you can start claiming the maximum benefit available to you.

Myth: Social Security benefits won’t be around for younger generations to utilize.

Fact: While there are concerns about Social Security moving forward, it’s not completely disappearing. Many estimate the Social Security trust fund will be gone by 2033, but taxpayers will still be paying into Social Security. This means that you simply have to plan appropriately, and current estimates suggest that you shouldn’t assume that you will receive more than 75% of your projected benefit unless something changes.

Making Social Security Part of Your Retirement Plan

Social Security benefits can often be confusing, but you don’t have to figure it out alone. Income for Life can help you figure out your total retirement plan, including how Social Security effects this plan for guaranteed monthly income. Consider some of these intricacies that the specialists at Income for Life can guide you through: