Life Insurance Planning

Life insurance isn’t for those who have died—it’s for those who are left behind. When shopping for life insurance, consider needs such as replacing income so your family can maintain its standard of living, as well as paying for your funeral and estate costs. A general rule is that you may want to seek coverage between five and seven times your gross annual income. As far as the various types of policies go, they can generally be placed into one of two categories: Term and Permanent.

Term Life Insurance generally provides coverage for a specified period of time and pays out a specified amount of coverage to your beneficiary only if you die within that time period. In a level premium term policy, you pay the same amount of premium from the first day of the policy until the term ends. Term life insurance is similar to renting an apartment. It is typically much more affordable in costs, but you do not own the plan. You are just renting it for a specific amount of time, therefore no equity is built.

“Investment losses within retirement hurt way more than big investment gains will ever help. That is why we believe so strongly in every retirement plan being built on the foundation of capital preservation and customized income planning.”

So, which Life Insurance strategy is best for you? Contact our office today to set up your Life Insurance Review at absolutely no cost or obligation to determine which strategy is best for you.

“The Treasury and the IRS are announcing steps that will ease regulatory barriers in the market for annuities and other forms of lifetime income.” Source: Alan Krueger, Council of Economic Advisors, WhiteHouse.gov. Feb 2012.)

Why Do I Need Life Insurance?

Quick Facts and Figures

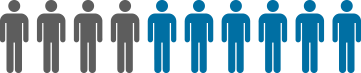

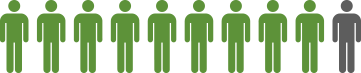

41% of the American Population Does Not Have Life Insurance.

That’s 95 million adults.

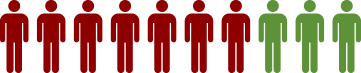

70% of Working Americans Would Suffer Financial Difficulty Within a Month After a Funeral.

50% of Americans that Have Life Insurance Say They Are Under Insured.

93% of Americans Agree that Life Insurance is Something They Need.

The “Life” in Life Insurance

While life insurance is typically used to supplement income for family members that are left behind and funeral expenses, there may come a time where you need to use your life insurance while you’re alive. Different life insurance and long-term care policies can provide support from built up equity for you and your family in a variety of situations. Consider the following:

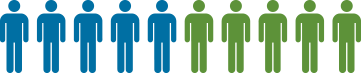

Social Security Beneficiaries as of December 2014

(Source: https://www.ssa.gov/policy/docs/chartbooks/fast_facts/2015/fast_facts15.pdf )

- 50% of Adult Americans Live with at Least One Chronic Illness.

- 70% of Americans Over 65 Need Some Sort of Long-Term Care.

- Average Cost of Private Room Nursing Home Care = $91,250/year.

- Estimated Cost of Private Room Nursing Home Care by 2035 = $199,900/year

Common Excuses Why American Adults Don’t Have Life Insurance

We’ve heard them all, but can you really afford not to have life insurance? Can your family afford for you not to be insured?

Life insurance is too expensive.

Truth: In reality, life insurance doesn’t have to be expensive. It can cost less than $100 a month for a good policy if you start planning early.

Life insurance is too hard to understand.

Truth: With the right help, anything is easy to understand. Let Income for Life help you find the policy that is the right fit for you.

I don’t need life insurance.

Truth: Almost every American needs some form of life insurance. If anyone relies on your income, then you absolutely need it.

I don’t plan on dying tomorrow.

Make the Smart Choice for Life Insurance

You have many different choices for where to shop for life insurance and your retirement planning, but not every company can offer you their services with no strings and at no cost to you. At Income for Life, we’re independent retirement strategists with only your best interest in mind. As individuals live longer, healthier lives, life insurance becomes an even more critical asset as part of your total retirement strategy.