Immediate Annuities

With an immediate annuity, you use a lump sum of money to purchase a contract from an insurance company in return for a guaranteed series of payouts. This stream of income is guaranteed for a specified period of time or for the rest of your (and even your spouse’s) life — no matter how long you live. The amount of the payout is based on several factors:

- How much money you use to buy the contract

- The interest rate environment at the time you purchase the contract

- The payout option you select (typically at the time the contract is issued)

- Your life expectancy — based on current age and gender

- The date you select for your first payment (within one year of issue date)

- Any additional features you choose

Immediate annuity income payouts may be either level or increasing periodic payments for a fixed term of years or until the end of your life, whichever is longer. Your income payouts will be taxed at ordinary income tax rates rather than the lower capital gains rates.

➢ One thing to take into consideration with an immediate annuity is, because there is no accumulation phase, you must annuitize immediately to receive income distributions. Once you annuitize with the life-only option, the transaction is irreversible and you no longer have access to your assets in a lump sum. When you die, any remaining contract value that could have been left to your beneficiaries is forfeited to the insurance company.

Do you have questions or concerns about how immediate annuities work or how they might fit into your financial plan? Contact our expert financial planner today!

Do You Need To Crack Open The Piggy Bank?

An Annuity by Many Names

While most of the time, you will hear immediate annuities referred to as just that, immediate annuities, they can also be called income annuities or payout annuities. This is because an immediate annuity is one you pay a lump sum into and start receiving guaranteed payments in as little as 12 months

Benefits of Immediate Income During Retirement

- No monthly payments. The premium is paid as one lump sum up front.

- Some contracts guarantee payouts until the day you die, no matter how long you live.

- You are able to provide guaranteed income for your spouse as well as yourself.

Benefits of Immediate Income During Retirement

- No death benefit. The insurance company keeps the entire lump sum when you pass.

- Annuitization is irreversible once you decide to initiate an immediate annuity.

- This option is not ideal for individuals in poor health or who are years away from retirement.

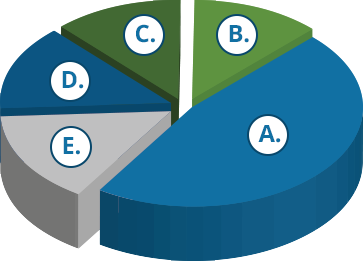

Average Cost of Living and Care During Retirement

(Source: http://www.forbes.com/sites/nancyanderson/2015/03/01/the-biggest-expenses-in-retirement-and-how-to-prepare-for-them-now/#643c8a466857)

While there will be room for fun when you retire, if you plan for it, there are set expenses that each and every retiree will have to contend with. According to Forbes Magazine, here’s where your money is going to go:

- A. 46.89% Housing

- B. 15% Food

- C. 13.82% Transportation

- D. 12.1% Medical Care

- E. 12.19% Other

Making the Right Choice for You

There are many times when a financial advisor will tell you not to purchase an immediate annuity. These times can include when you’re far from retirement or when you’re in poor health. However, if you’re very close to retirement or are already retired and worried your income may run out too soon, then they may be the right fit for you. Let Income For Life’s team of retirement planning specialists help you make sure you have the right retirement portfolio to keep you retired.